Headquarters: Svetog Nauma 7, 11000

Office address: Đorđa Vajferta 13, 11000

Phone:: +381 11 4529 323

The Western Balkans sit at a crossroads of global influence, where the shifting tides of U.S.–EU relations exert growing economic and geopolitical pressure. As transatlantic dynamics devolve, the region finds itself increasingly entangled in a competition over investment, trade partnerships, and strategic alignment. Yet, it remains unclear how are evolving U.S.–EU dynamics shaping Western economic leverage and geopolitical influence in the Western Balkans. Answering this question becomes all the more important as rival powers simultaneously seek to expand their influence. The argument is that evolving U.S.–EU relations will shape the Western Balkans’ economic dependencies and strategic alignment—either reinforcing Euro-Atlantic integration or creating openings for rival influence—depending on the coherence and depth of Western engagement. In this light, recent tariff clashes appear to undermine unity and tilt the balance toward the latter.

Fragmented Western Approaches and the Struggle for Influence in the Balkans

Trump’s protectionist trade policies disrupted the global economic sphere, threatening ties with key allies and allowing for rival powers to expand their influence. The Trump administration’s decision to impose broad tariffs on steel and aluminum in March 2025, including a 25% tariff on steel imports that impacted EU nations and sparked a wave of retaliatory steps from allies, is one of the best examples. Already in April, President Trump declared “Liberation Day,” unveiling sweeping tariffs. These tariffs targeted every nation in the world with a universal 10% baseline in what Trump is calling a “declaration of economic independence”. Simultaneously, this action reignited the imminent trade war with China. This escalation began with an initial 10% tariff in February, followed by increases to 20% in March, and a significant 34% reciprocal tariff in early April. An additional 50% was implemented on April 9, culminating in the current total of 145%. In retaliation, China has levied a 125% tariff on U.S. goods, effective since April 12, 2025. With such actions unfolding over a very short time span, the world enters a new phase of economic uncertainty.

The fact Trump also pulled back from multilateral trade institutions and partnerships, made it harder for the West to present a united economic front. For instance, Trump’s decision to sideline the WTO and lean into bilateral deals, moved away from global trade norms – giving outside powers more room to move in. Friction between the U.S. and the EU reached an all-time high when the Trump administration included a 20% tariff rate on EU imports. In the meantime, both sides continue accusing each other of unfairly supporting their aviation industries, made it even harder for them to present a united front on trade. The fact that Trump kept challenging Ukraine’s right to self-defense, as well as outbursts of expansionism towards Danish Greenland, further complicated matters. With such actions, Trump’s Administration set the US on a clearly divergent path from the EU that keeps favoring free-trade, partnership-based, and predictable global order.

As the U.S. and EU do not always move in sync, other actors are gaining more foothold to increase their leverage. Namely, even before Trump’s first term, China and Russia started offering big infrastructure and energy projects to the countries of the region without requiring democratic reforms or transparency. For countries in the Western Balkans, that can look like an easier option, even if it distances themselves from democratic values. Now, with Trump distancing his administration from the EU and by extension from the Western Balkans, one could imagine Beijing will continue with its investment via the Belt and Road Initiative to the region, where they have over 20 billion euros on over 136 projects since 2014, and Russia to continue holding its tight energy grip and spread disinformation. To safeguard the Western Balkans’ path toward Euro (-Atlantic) integration, greater coherence and coordination between the U.S. and EU will be essential—without it, the region risks drifting toward alternative models of influence that could undermine democratic consolidation, the rule of law, and long-term stability.

Collateral Damage: How U.S.–EU Trade Tensions Undermine Balkan Stability

Trump’s tariffs on EU goods indirectly hurt Western Balkan economies by disrupting supply chains and dampening export demand. The proposed tariffs almost immediately triggered a response in the form of EU counter-tariffs that have an overall negative impact on transatlantic trade. The Western Balkan markets are heavily reliant on selling goods to the EU supply chain, especially in the metals and machinery sectors. All Western Balkan countries do the most trade with theEuropean Union — both in exports and imports, including 70% of all regional exports, according to the European Commission. This would cause a ripple effect as the increased prices due to tariffs would definitely reduce the overall production for the US market and reduce the product sourcing of Western Balkan goods. When the EU economy slows, it hits the Balkans hard as exports drop, investment drops, and factories scale back. Jobs tied to EU trade, especially in manufacturing and transport, are often the first to go. Without stable EU demand, the region’s economic momentum could be put at serious risk.

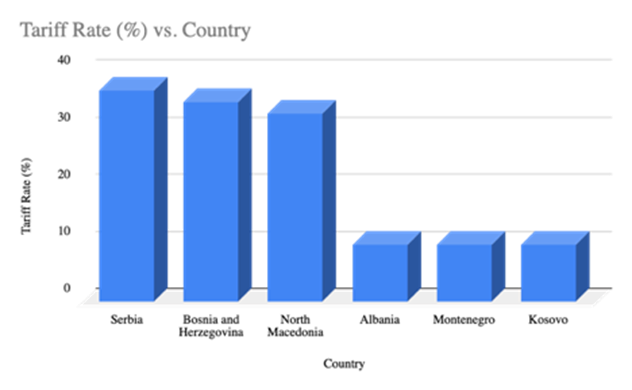

In addition, the Western Balkans have been disproportionately affected by newly imposed U.S. tariff rates, though the primary impact is likely to remain indirect. While Albania, Kosovo, and Montenegro have maintained a 10% tariff rate, Serbia, North Macedonia, and Bosnia and Herzegovina now face rates in the mid-30% range (see Table 1)—a steep increase from the prior 2–5% most-favored-nation (MFN) rates. These rates were determined using a questionable formula: the U.S. goods trade deficit with each country, divided by the value of U.S. goods imports from that country, and then halved. This calculation appears to penalize countries like Serbia, North Macedonia, and Bosnia and Herzegovina, whose national statistics suggest they consistently import more from the U.S. than they export.

Serbia is a particularly evident case. A major statistical discrepancy arises from Fiat car exports produced in Kragujevac, Serbia. While Serbian national statistics log these vehicles as exports to Italy, U.S. trade records list the same imports as coming from Serbia—since the cars, though routed through Italy, originate in Serbia. This mismatch inflates Serbia’s apparent export figures to the U.S. and helps explain why it faces a disproportionately high U.S. tariff rate under Trump’s new formula. Without fairer trade calculations, Serbia and other Western Balkan countries risk being kept under Trump’s proposed tariff rates, which in turn could harm growth and regional stability.

While the direct economic shock from these tariffs is limited by the small volume of U.S.–Western Balkans trade, the tariffs’ symbolic and strategic impact is notable. The region’s real vulnerability lies in its indirect exposure to EU economic shifts. The Western Balkans are tightly linked to EU production chains—especially in metals and machinery—and any slowdown in major EU economies like Germany or Italy reverberates across the region. Though theoretically, higher tariffs on EU goods could incentivize companies to relocate production to lower-tariff Western Balkan countries, the current industrial capacity of these states makes such relocation unlikely in the short term. Trump’s temporary 90-day freeze offers a narrow window for diplomatic negotiations. Given the small economic footprint but high strategic relevance of the Western Balkans, reducing or eliminating these tariffs would send a strong signal of transatlantic alignment and help preserve the region’s Euro-Atlantic trajectory.

Table 1. Regional Average Tariff Rate: Approximately 22.5% ( Newsweek)[1]

The need to take a more strategic approach vis-à-vis the region becomes all the more important, as the non-Western actors are more than ready to jump and fill in any gaps that might open in response to new trade fluctuations. When Western strategies feel fragmented or short-term oriented, long-term investment becomes riskier, and reform becomes a lower priority. China and Russia are quick to fill the gaps with large-scale infrastructure or energy deals that come with fewer strings attached, offering speed and funding without demanding transparency or democratic change. Over time, this weakens alignment with Western standards and delays progress toward EU accession. It also creates deeper economic and political dependencies that are harder to reverse. Though not the intended target, the Western Balkans have been indirectly hit in the fallout of U.S.–EU trade tensions. Under Trump’s new tariff policy, the region is now more vulnerable to economic shocks, slower democratic reforms, and growing external influence from authoritarian powers. Without renewed transatlantic coordination and a clearer shared strategy, the West risks losing its foothold in a region still critical to Europe’s long-term stability.

[1] These tariffs were calculated using a formula that considered the U.S. goods trade deficit with each country, divided by the U.S. goods imports from that country, and then halved. This methodology resulted in higher tariffs for countries with which the U.S. had larger trade deficits.